Architects and Cash Flow: Why It’s Always a Pain, and How to Fix It

You don’t need to be an accountant to master this.

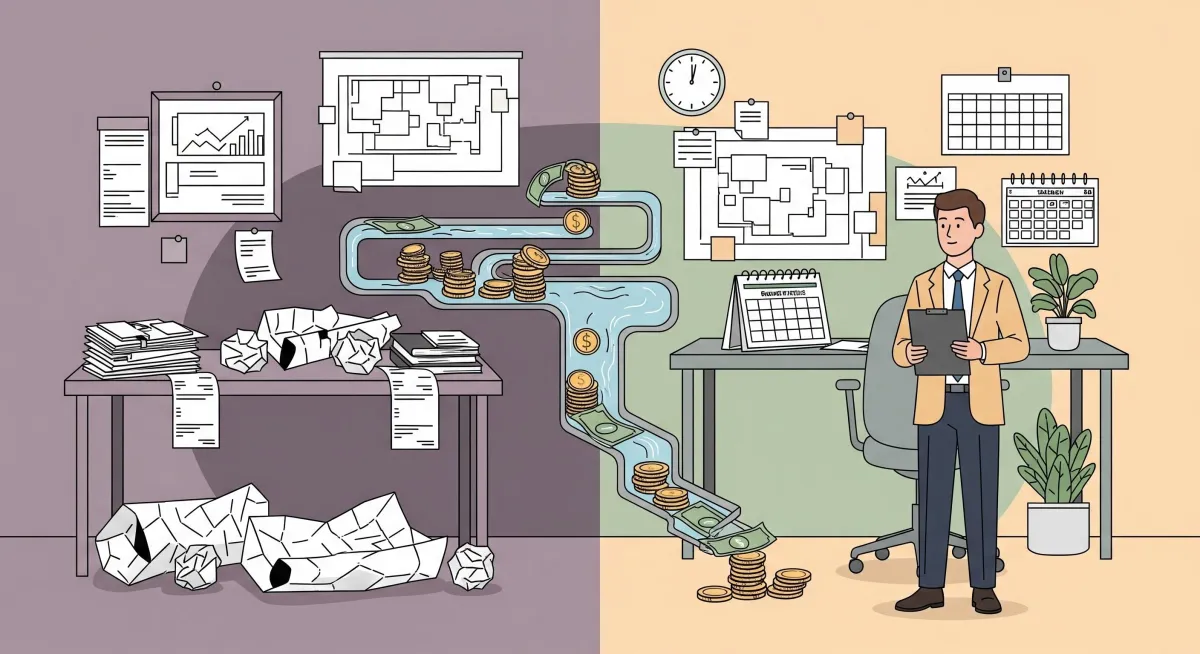

The Quiet Crisis of Cash Flow in Architecture

Cash flow isn’t a buzzword. It’s the lifeblood of your practice.

One month you’re fine. Next, you’re sweating payroll while a big invoice drifts late.

Over 62% of UK practices face cash flow issues every quarter.

The good news: steady cash flow is achievable with a few simple systems, habits, and a clear plan.

Why Cash Flow Is So Difficult for Architects

Architecture has unique cash challenges:

Irregular payment intervals: Milestone billing means lumpy, hard-to-forecast income.

Extended payment cycles: Architectural invoices take around 43 days to be paid.

Front-loaded effort: Heavy design work often happens before the first invoice.

Seasonal slowdowns: Holidays and year-end push receipts back.

When a handful of large client payments drive your bank balance, small delays create big stress.

The Most Common Cash Flow Mistakes

Let’s call out the usual suspects, and the quick fixes:

Relying on memory instead of a forecast → Fix: Run a 13-week rolling forecast every Monday.

Invoicing late (or not at all) → Fix: Calendarise billing on the last working day of the month.

No payment chasing system → Fix: Use a Day 0/7/14/21 cadence (see Step 5).

Misaligned payment schedules → Fix: Move to monthly billing or retainers to match monthly costs.

No safety buffer → Fix: Ring-fence two months’ outgoings as a cash reserve.

The fix is visibility, predictability, and proactive control.

Step-by-Step: How to Fix Your Cash Flow Problems

Use a 13-Week Rolling Cash Flow Forecast

Build a simple weekly spreadsheet that shows expected cash in and cash out. Update it every Monday.

Set it up with columns: Week, Opening Balance, Cash In (by client), Cash Out (payroll, rent, software, tax), Net Movement, Closing Balance.

Add a recurring reminder: Update forecast, Mondays 09:00.

Map Project Cash Flow

For each job, track when you’ll invoice, the terms, the expected receipt, and key costs.

Create a one-line view per project: Stage, Invoice date, Terms, Expected receipt, Key costs.

Overlay projects to spot any week where Closing Balance drops below your buffer.

Front-Load Your Payment Terms

Shift to monthly billing or secure mobilisation payments, especially in design-heavy phases.

Align effort with income.

Sample clause you can lift: “Our standard terms are 40% mobilisation on appointment; monthly billing thereafter; 14-day payment terms; work pauses automatically at 14 days overdue. Statutory interest may be applied under the Late Payment of Commercial Debts Act.”

Build a Two-Month Cash Buffer

Calculate average monthly outgoings x 2 = Buffer target.

Open a separate savings account named Operating Buffer and automate a weekly transfer until you hit target.

Firms with this buffer are far more resilient in downturns.

Automate Invoice Follow-Ups

Turn on reminders in your accounting software and use a simple chasing cadence:

Day 0: Invoice sent with a friendly “please confirm receipt”.

Day 7: Polite reminder with the PDF attached.

Day 14: Firm reminder; propose a quick call if there’s an issue.

Day 21: Phone call; agree a payment date and confirm in writing.

Day 30: Overdue notice referencing terms and potential interest.

Spread Out Large Expenses

Switch annual software licences to monthly.

Ask suppliers for 30-day terms.

Stagger equipment purchases quarterly.

Smooth outflows to match inflows.

Diversify Your Revenue

Add smaller, upfront-fee services for faster cash injections and better predictability:

Feasibility studies

Planning risk reviews

Pre-application advisory packages

This week (quick wins)

Build your 13-week forecast.

Send invoices on the last working day of the month.

Turn on automated reminders.

Start 1% Profit transfers (see below)

Mindset Shift: Prioritise Profit First

Most firms follow: Income – Expenses = Profit.

Flip it: Income – Profit = Expenses.

Start small. Move 1% of every receipt into a Profit account this month. Increase by 1% each quarter.

This approach pays you first and forces healthier spending discipline, often lifting margins without raising fees.

The Tools You Need (and Don’t Need)

You don’t need:

A finance degree

Fancy software

A full-time bookkeeper

You do need:

A simple cash flow forecast

A standard invoicing and follow-up system

A payment schedule template

Weekly discipline to run the process

Whatever tools you choose, make the forecast and chasing cadence weekly habits. Tools help. Discipline wins.

Real Results: What a Cash Flow System Can Do

Practices using these steps report:

Far more predictable cash flow (surprises cut by up to 80%).

Stress levels are dropping within two months.

Profit margins are rising by up to 9%.

The impact is real. Clear headspace. Stronger team retention. Confidence to invest, without sleepless nights.

Your Practice Deserves Stability

Architecture is complex enough. Cash flow doesn’t need to be.

Put a few basic systems in place and turn a monthly emergency into a routine you control.

Download the Cash Flow Tracker Template

Set up your 13-week forecast in 15 minutes

Add your projects and spot pinch points fast

Run your Monday cash huddle with confidence

Start forecasting today and take the first step towards a more stable, profitable practice.